The numbers don’t lie. We’re in a relatively mature, stable industry with plenty of growth opportunities ahead.

The numbers don’t lie. We’re in a relatively mature, stable industry with plenty of growth opportunities ahead.

It’s that time of year again — summer season’s numbers are in and it’s likely that they’re not too shabby. It’s a time of increased training and, in some locations, equipment winterizing. Your office team is finally catching up on paperwork. Your termite crews are lamenting the colder crawlspaces. And your general pest control techs are seeing an influx in rodents and occasional invaders looking for a place to overwinter in customers’ homes.

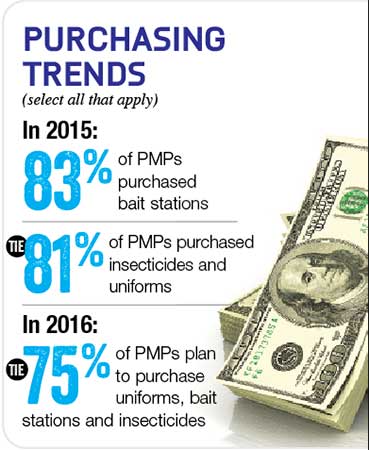

But let’s back up those generalizations with some hard data. That’s where our annual Pest Management Professional (PMP) magazine’s State of the Industry, 2016 edition, comes in. It’s likely there is little in this year’s survey that will astonish you — for example, 86 percent of responding firms have been in business for more than a decade. Nearly half (47 percent) have been around for more than 25 years. Their top purchases in 2015 (and planned purchases in 2016) include bait stations, insecticides and uniforms.

It’s those little things that can be astonishing, however. For example, in answers for the open-ended question of “What do you see as the top opportunities for your company in 2016,” expansion and growth were recurring themes. Not so unusual for small-business owners, of course, but it was how some of them plan to expand that caught our attention. For example:

- DIY failures

- Birds — airport management

- Continued growth in scorpion control

- Only provider of mole service in the county

- Growth in mosquito, brown recluse and bed bug markets

Growth through bed bug calls and do-it-yourself customer disasters, sure — but scorpions? Moles? Mosquitoes and brown recluses? It gave us pause to think that while the “usual suspects” (and the ones you’ll read about when you turn the page, the “Fab Five” of ants, bed bugs, cockroaches, rodents and termites) are still pulling down big numbers for pest management professionals (PMPs), some of the second-string accounts — the mosquitoes, the stinging insects, the occasional invaders — aren’t far behind. That’s why we examine “Ones to Watch.” See how your accounts with lesser-known pests stack up against what our respondents reported for this year and projected for the year to come.

Finally, we’re wrapping up our 2016 PMP State of the Industry coverage by getting down to business — literally. “Business 101” takes a look at how the numbers add up for PMPs across the nation.

The year ahead

This year’s survey asked PMPs to look into the future and report what they perceive as major issues for 2016. Two facets that are still on the right track — after the lengthy economic downturn — are employee and sales growth. A full 73 percent of respondents expect to gain employees in 2016 (up from 61 percent who grew their teams between 2014 and 2015). For both years, 3 percent expect to (or did, in the case of 2015) double their current teams.

This year’s survey asked PMPs to look into the future and report what they perceive as major issues for 2016. Two facets that are still on the right track — after the lengthy economic downturn — are employee and sales growth. A full 73 percent of respondents expect to gain employees in 2016 (up from 61 percent who grew their teams between 2014 and 2015). For both years, 3 percent expect to (or did, in the case of 2015) double their current teams.

To pay for all that new staffing, there has to be a sales increase: an impressive 3 percent of respondents increased sales by 100 percent or more. In 2016,

4 percent expect to accomplish this feat. Still, tallying the numbers of everyone who said sales grew in 2015 (92 percent) and/or are going to grow in 2016 (94 percent) was impressive. It seems the concept of “grow fast or die slow” has caught on in the industry.

That said, nearly one-third of respondents kept the same staffing level in 2015, and approximately 23 percent do not expect to change their employee numbers in the new year. Still, nearly everyone is optimistic about sales growth, with just 1 percent reporting flat sales in 2015 and 2 percent staying the same in 2016.

Big sales, of course, don’t automatically equal big profits, especially if there’s a lot of overhead. And boy, did we hear about overhead — from healthcare coverage to liability insurance, from taxes to truck maintenance – respondents didn’t hold back. Other barriers they cited include:

- The speed at which we can implement our plans

- PMPs underselling services to get or keep customers; integrity in our industry needs work

- Recruitment of talented individuals to continue the growth of the business

Yet the overall snapshots of net profits from 2014 to 2015, and again from 2015 to 2016, are still solid overall. Thirty-nine percent report 2015 profits were up 10 percent to 24 percent over 2014’s numbers. Nearly 5.5 percent report they doubled their profit over 2014, and only 7 percent saw a flat or decreased figure.

Looking ahead to next year, the story is much the same: 39 percent forecast a bump of 10 to 24 percent over 2015, while 2 percent hope to double their profits. About 4 percent predict they will not deviate from their 2015 rate. Another 4 percent believe they will see diminished profits in 2016.

An election year and continued unpredictable weather will combine to keep our industry on its toes, both in the office and the field.

Leave A Comment