To say I’m a fan of pizza is an understatement. A few years back, I received a call from one of the many pizza shops I regularly support. The place burned down, and its owner was reassuring me he’d be back in business within a few months.

“I bet the pizza shop’s latest loan was contingent on re-securing your business!” Kevin Stoltman, my boss, quipped.

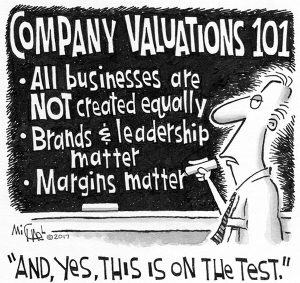

Being a pizza fanatic, I perked up at PestWorld when John Corrigan — Esq., MBA, CPA and managing director at PCO M&A Specialists (a division of PCO Bookkeepers) — compared company valuations to pizza: “Too many think all slices of business are created equal. Far from it. Is it thin, traditional or deep dish? Is it plain, pepperoni-and-sausage, or deluxe? What’s the quality of the dough, sauce, cheese and toppings?

“There’s no one-multiple-fits-all for M&As (mergers and acquisitions),” he added. “For starters: What are the company’s sales — and margins — for termite, bed bug and general pest control? What’s the commercial, residential and municipal mix? What percentage of revenue is recurring? What’s the average customer longevity? What’s the technician turnover rate?”

This is just one slice of M&A knowledge. Turn to “M&A: How to maximize your pest management firm’s potential“, “How changing interest rates affect company valuations,” “M&A: Don’t overlook tax impact on sellers,” and “Pest industry M&A: A historical perspective” for more on M&As.

Publisher & Editorial Director Marty Whitford can be reached at mwhitford@northcoastmedia.net or 216-706-3766.

Leave A Comment