PHOTO: JJ GOUIN/ISTOCK / GETTY IMAGES PLUS/GETTY IMAGES

Sitting at my computer chair looking out the window at the storm clouds rolling in and I can’t help but think that those storm clouds are a metaphor for the economic storm approaching us in 2021. Vestiges of the 2020 tempest are stubbornly clinging to the coattails of 2021. Last year brought an excruciating economic hardship to small businesses and mom-and-pops. Small, non-essential businesses, were forced to shut down, customer confidence was shaken and foot traffic sales were, at the very least, diminished if not entirely eradicated during the shutdowns.

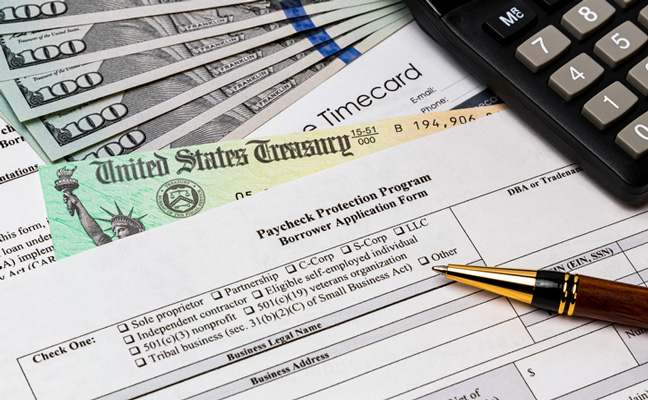

These economic hardships led the U.S. government to issue the Paycheck Protection Program (PPP). With a payroll summary supporting the average 12-month payroll calculation, the most recent tax return, an annual profit and loss statement along with three months worth of business bank statements, small business owners could visit their local bank and apply for the federally backed loan to ease the economic stress. Unfortunately, economic cyclones have persisted into the new year and a second round of PPP loans are now available.

Luckily, many pest control businesses not only survived but grew during the 2020 chaos. That being said, the thought that should cross everyone’s mind if they filed for 2020’s PPP, and certainly should consider if they are applying for 2021’s PPP: how strong is the financial future of their business if they require outside loans to keep their business afloat?

This is not to say that all loans for business are adverse. Strategically planned growth loans such as loans for new equipment, marketing a new vertical, etc., can be extremely beneficial, even necessary, for small businesses to succeed. But the PPP is not designed to help a business grow into new markets, or increase its productivity. The PPP is designed to help a business stay afloat during this economic typhoon.

Businesses that took advantage of the loan did not do anything wrong. Every business has its own story to write and it would be foolish to try and predict or judge the needs of another’s business from my office chair.

What I am saying is if you needed the PPP to stay afloat, you should consider fortifying the financial health of your business to provide for your future economic freedom. Economic turmoil is nothing new to small businesses, there are boons and busts in a cyclical fashion. What can you learn from your business’ money management processes? How can you secure the longevity of your business’ profitability in the face of persistent economic tidal waves?

Those who need the PPP should consider it a red flag warning. The business currently is not financially healthy. A business surviving on debt is shaky indeed. As we continue to work our way through 2021 we should ask ourselves the following question; Does my business have (at least) three months of retained earnings to weather economic storms?

Eric Palmer, owner of Southwest Exterminators

If the answer is no, this is a red flag warning. A healthy, profitable and fiscally responsible business will have 3-6 months retained earnings available to float themselves during the tempest. I do not know your story, I do not know the story of your business, and I am not chastising you if you have or have considered taking the PPP. What I am offering is an invitation to take this opportunity to look at the financial health of your business and ask yourself: how can I make it stronger?

Eric Palmer is the owner of Southwest Exterminators, the founder of 7 in 6 Consulting and the author of Scale2Succeed. If you have any questions you can reach him at info@scale2suceed.com.

Leave A Comment