Dan Gordon, CPA

On Dec. 22, 2017, then-President Trump signed into law the Tax Cuts and Jobs Act, which brought about sweeping changes to the tax code. Most of the provisions were business-friendly, but one particular provision limited the amount of state and local taxes (SALT) a taxpayer (married filing jointly) can deduct to no more than $10,000. SALT taxes include state income taxes or general sales taxes if elected, instead of income taxes, real property taxes and personal property taxes.

In states that have low or nonexistent personal income taxes and/or low property taxes, this provision was not as detrimental to taxpayers as those who live in states with higher SALT rates. In fact, the limitation on this deduction was a very hot topic, with many states trying to negate this limitation through several workaround ideas such as charitable deductions and payroll tax credits — none of which were workable.

Enter the pass-through entity (PTE) tax. For reference, a pass-through entity is one that is not taxable itself, but the income/loss passes to its owners for inclusion on their personal tax returns. Examples of PTEs include partnerships, sole proprietorships and S Corporations.

HOW PTE TAX WORKS

The premise of the PTE tax is straightforward. By imposing an income tax directly on the PTE, which is not limited in the amount of state taxes that it can deduct for federal purposes (like individuals who are capped at $10,000), a state’s tax on PTE income now becomes a full deduction for the PTE for federal income tax purposes.

The mostly optional tax allows eligible PTEs to pay state income taxes at the entity level. Those income taxes can then be fully deducted for federal tax purposes. The deduction is then passed through in the distributive share of the PTE owners’ income. The laws enacting these optional taxes usually allow the owner to do one of the following:

- Claim a credit for the owner’s distributive share of the taxes paid by the PTE.

- Exclude the owner’s distributive share of the PTE’s income.

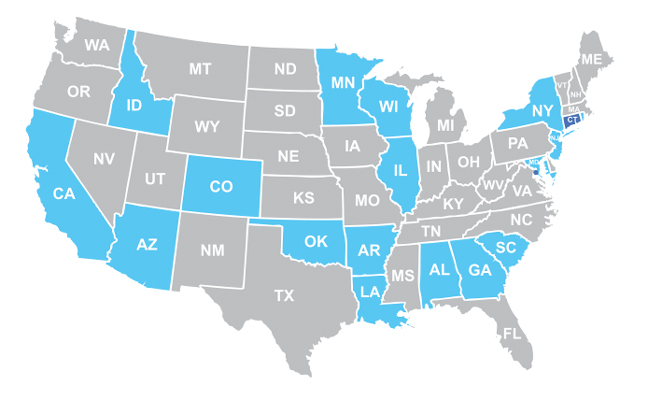

As of press time, Connecticut and Washington, D.C., make the PTE tax mandatory. Another 17 states have enacted legislation that makes payment of the tax elective. (See map below.) The calculations for companies that operate in multiple states can be somewhat complicated, as they need to properly allocate income and expense items to the various states in which they operate. For this reason, it is a good idea to discuss the planning around PTE taxes with your tax advisor to maximize the deduction without running afoul of the rules.

While it takes a little extra work to perform the calculations, make the entity-level tax payments and take the credits or exclusions if you pay more than $10,000 in SALT on your personal return and you own a PTE that is profitable. It is a no-brainer to use the PTE tax to reduce your tax liability.

PTE tax legislation jurisdictions

Payment of the pass-through entity (PTE) tax may be mandatory or elective, depending on where a company operates. As of this writing, the following jurisdictions have enacted PTE tax legislation:

Mandatory:

Illustration: Pavlo Stavnichuk/iStock / Getty Images Plus/Getty Images

- Connecticut

- Washington, D.C.

Elective:

- Alabama

- Arkansas

- Arizona

- California

- Colorado

- Georgia

- Idaho

- Illinois

- Louisiana

- Maryland

- Minnesota

- New Jersey

- New York

- Oklahoma

- Rhode Island

- South Carolina

- Wisconsin

Leave A Comment