Photo: New Africa/Shutterstock.com

The labor inflation statistics for the pest control industry suggest pest management firms, along with the rest of the economy, are facing many challenges. On the flip side, as an industry, we also are experiencing incremental growth year-over-year.

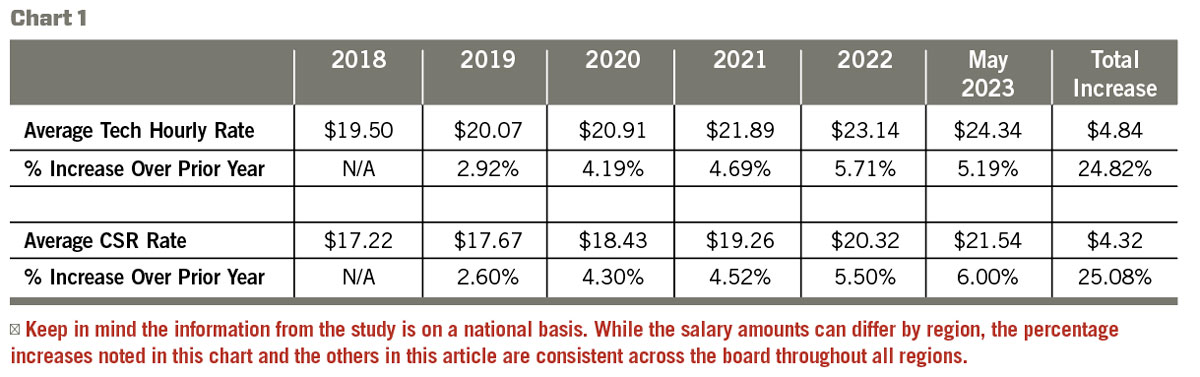

My company, PCO Bookkeepers & M&A Specialists, has finished a study that focuses on labor data extracted from more than 400 of our clients in 47 states from May 2018 to May 2023. While the data aren’t perfectly comparable because companies in the sample have different compensation arrangements with employees, as well as different job descriptions and responsibilities for various positions, my team and I believe the results presented in this article paint an accurate picture of what is going on in the overall economy, as well as the pest control industry. When we compared our data against data published by the U.S. Department of Labor, our data points appear to be well correlated.

Our study was conducted on two classifications of labor: technicians and customer service representatives (CSRs). We didn’t include salespeople, supervisors or managers in our study because for the most part, a good chunk of their compensation plans depends on commissions or bonuses based on performance. While performance can change during the period we analyzed, a change in pay would not necessarily be caused by wage inflation, but rather by other criteria.

In our data comparison, differences were caused by items such as technician pay plans: hourly vs. percentage of production vs. a hybrid between the two. Another large difference is that in certain companies, CSRs are responsible for sales, whereas others have dedicated salespeople. In looking at the data, we have normalized it, so we could draw trends and get to some meaningful conclusions.

According to Chart 1, for pest management professionals (PMPs) to maintain the same margins in 2023 as they did in 2018, the price increase required over the same period should have been about 25 percent. This assumes that not only did labor increase by this much, but that all expenses have increased proportionately. Based on overall inflation data, this seems to be the case.

CHART: PCO BOOKKEEPERS & M&A SPECIALISTS

The proportion of wage growth

As I write this in mid-November, the labor market in our industry is tight. The wage growth over the past three years is barely keeping up with inflation.

From an employee’s perspective, the increase in salary is great; however, there is little growth in nominal wages — those measured in current dollars and not adjusted for inflation. From an employer’s perspective, the raises given and the starting salaries in the current environment seem astronomical. But the reality is that inflation in the overall economy has driven prices of all goods and services higher.

The U.S. Bureau of Labor Statistics’ Consumer Price Index (CPI, found online at BLS.gov) is the average inflation rate for a basket of goods and services surveyed and reported each month. Looking at wage pressure over the pandemic years of 2020 to 2022, it appears labor in our industry has exceeded the CPI. While an “average” is the typical value in a data set, labor cost is at the top of that data set. This means the labor rate in our industry has exceeded the CPI.

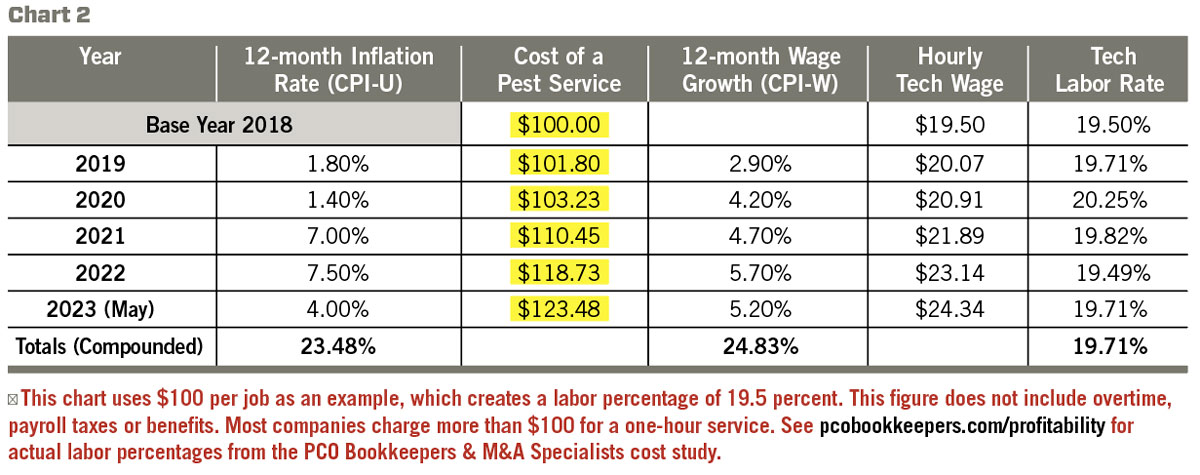

According to our PCO Bookkeepers & M&A Specialists’ labor study, technician labor cost to PMPs increased by an average of 24.83 percent — as seen in Chart 2. Note that in the chart, CPI-U equates to the inflation rate of a basket of goods designated by the Bureau of Labor Statistics. CPI-W, meanwhile, stands for wage inflation. The data show that from January 2019 to May 2023, with 2018 being the base year, wage inflation was higher than any time in the recent past.

CHART: PCO BOOKKEEPERS & M&A SPECIALISTS

If we are paying more, why isn’t it easier to recruit good talent? According to the U.S. Bureau of Labor Statistics for the past two years, the number of unemployed people per job opening has been running around 0.5. That means there are approximately two jobs available for every unemployed person in the U.S.

At the same time, the average wage increased by 24.83 percent over the base year, and the CPI increased (inflation) in the overall economy by 23.48 percent. Based on this data, PMPs would need to raise prices for services over the period of January 2019 through May 2023 by about 25 percent just to keep the industry profit model intact and hold the line on nominal profit.

As I have explained many times in my “The Bottom Line” columns over the years in this magazine, the gross margin for best-in-class companies needs to be more than 50 percent, with total cash flow to ownership exceeding 20 percent. Chart 2 shows us technician labor averaged $19.50 in May 2018 and increased to $24.34 by May 2023. In 2018, average hourly wages for a technician providing service at $100 per hour would cost 19.5 percent of the profit-and-loss statement (P&L). If the desire is to keep the hourly wage at around 19.5 percent — actually 19.71 percent, according to the chart — that $100 service now costs the customer $123.48.

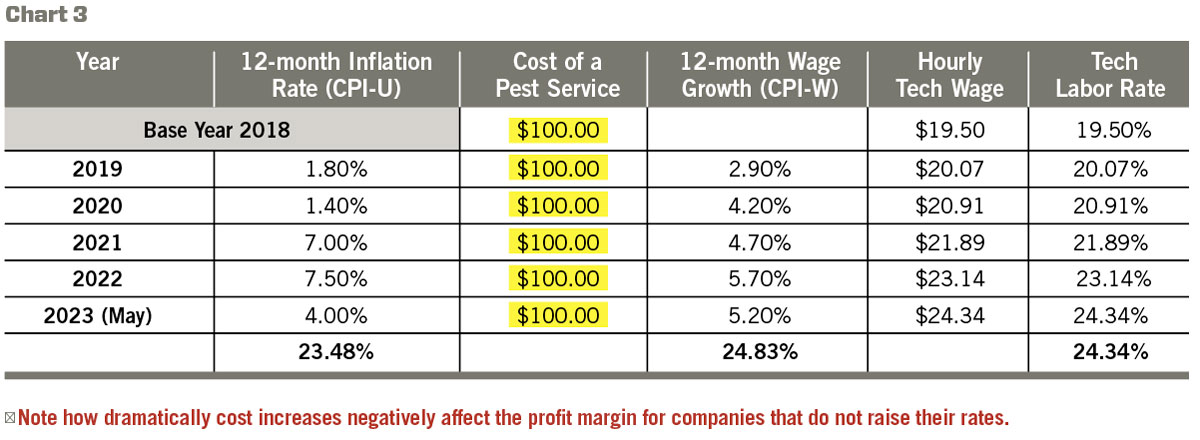

Let’s look at Chart 3, above, and see what would happen had we kept our head in the sand over the period of January 2019 through May 2023, and did not raise prices to keep pace with inflation in the overall economy or wages.

CHART: PCO BOOKKEEPERS & M&A SPECIALISTS

If customer pricing for the service mentioned above remained at $100, as illustrated in Chart 3, the labor percentage has increased from 19.5 percent to 24.34 percent. This differential of about 5 percent would come right from the bottom line, decreasing our net margin from 20 percent to 15 percent for best-in-class companies. That’s a full 25 percent reduction in profit.

Remember, this a reduction in profit based on direct labor. If we extend our example to include sales and office labor, we can more than double that degradation of profit. And if we further extend the example to non-labor items such as insurance, fuel, benefits, materials and more, our best-in-class company that was showing 20 percent net to owners in 2018 is losing money in 2023.

2024 predictions

It appears just about everyone has strong opinions about whether the economy, inflation, energy and labor will get better or get worse in the new year.

Dan Gordon, CPA

Before I give my predictions, I’d like to explain where in my opinion the sweet spot for the economy lies with respect to the pest management industry. On the surface, it appears that a strong economy is good for business and a weak economy is bad for business. And of course, I would agree that a weak economy is bad for all business. But what about a mediocre economy?

I would argue that a mediocre economy is most desirable for pest management. In this type of environment, people have money to spend, albeit cautiously, and the job market is not so tight that we can’t hire good people.

If we look at the past 12 to 15 years, coming out of the Great Recession of 2007 through 2009, there was growth. While it was lackluster for quite some time, our industry fared well.

By contrast, when the economy heated up in the past few years after tax cuts, COVID-19 relief and extremely low interest rates, the labor market became extremely tight. In fact, it was so tight I had several clients tell me they curtailed their marketing spending because they couldn’t handle any more work their marketing generated.

That said, where does my crystal ball take us? By the way, I’m not responsible if you rely on my predictions; you should formulate your own opinions and conduct your own research. Here goes:

- Labor costs will stabilize. We saw the end of blue-collar labor inflation once Amazon retreated after COVID-19 and started layoffs instead of pushing up the price of warehouse labor. While I do not see the cost of labor going backward, I do see it stabilizing. Hiring should become a bit easier next year.

- Inflation will go down. In my opinion, Federal Reserve Chair Jerome Powell tried like heck to destroy our economy by raising interest rates very quickly. While the economy has prevailed, Powell destroyed Silicon Valley Bank and a few other regional banks with his strong medicine. He also managed to curtail inflation, so I believe inflation will be substantially lower in 2024.

- Fuel costs may stabilize. Inflation hit fuel very hard. The war in Ukraine also was supposed to have a dampening effect on fuel availability. Well, inflation is down and, as I write this in November, the war rages on — but fuel prices have come down significantly from the top. I think fuel prices in 2024 will continue where they are, barring a major geopolitical event.

- The economy will see modest growth. The reality is that higher interest rates not only cool inflation, but also knock down gross domestic product growth. I am hopeful that the Federal Reserve will start to decrease interest rates in 2024. If that happens, we should get modest growth, which will keep us from falling into a recession.

- Interest rates will go down. Where can they go but down? That is my prediction for 2024.

Leave A Comment