Photo: Soulmemoria / iStock / Getty Images Plus / Getty Images

Like most accountants, at this time of year I often get the question “How can I pay fewer taxes?”

There are several ways to reduce taxes, but one of the best tax reduction ideas for a growing small business is to acquire equipment or vehicles for expansion, or replace existing equipment or vehicles.

Under Section 179 of the Internal Revenue Code, if a business and the assets they are acquiring meet certain requirements, those assets can be fully expensed in the year acquired. There is no requirement that cash be expended for those assets in the current year, making financing and leasing even more attractive.

Section 179 doesn’t increase the total amount that can be deducted, but it does allow a business to get the entire depreciation deduction in one year, rather than taking it a little at a time over the term of an asset’s useful life — which for equipment and vehicles can be five years or longer.

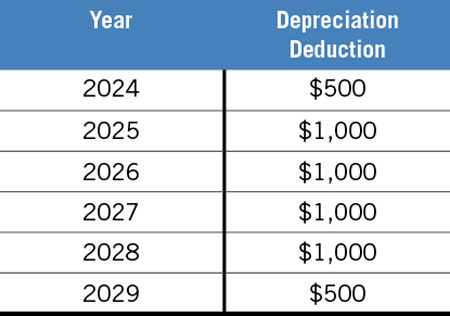

For example: In 2024, Cheap Shot Pest Control buys a $5,000 piece of equipment. Under the regular depreciation rules (using the straight-line depreciation method), it would have to deduct a portion of the cost each year over its five-year useful life as follows:

By deducting the equipment using the Section 179 deduction, Cheap Shot can deduct the entire $5,000 expenditure from 2024 income. In this manner, the company receives a $5,000 deduction in 2024 under Section 179, instead of the $500 deduction it would normally get using straight-line depreciation (with a half-year convention).

Qualifying equipment

The Section 179 deduction only applies to assets purchased that are used more than 50 percent in the business (vs. personal use). If the equipment is used less than 100 percent, but more than 50 percent for business, the cost must be prorated because the personal portion is not deductible under any method. The following is a list of purchases that qualify for 179 expensing:

- Equipment purchased for business use.

- Tangible personal property used in business.

- Computers.

- Computer “off-the-shelf” software.

- Office furniture.

- Office equipment.

- Other tangible assets.

- Non-personal use vehicles.

Vehicles qualified as non-personal use vehicles are specifically modified for business, such as a van with permanent shelving replacing passenger seating and an exterior painted with the company’s name.

IRS Publication 946 provides guidance as to vehicles meeting the requirements of non-personal use vehicles.

Non-qualifying equipment

Under Section 179, you can deduct the cost of tangible personal property (new or used) that you buy for your business if the IRS has determined the property will last more than one year. You cannot, however, use Section 179 to deduct the cost of:

- Land.

- Permanent structures attached to land (buildings and their structural components, fences, swimming pools, paved parking areas, etc.).

- Inventory.

- Intangible property such as patents, copyrights and trademarks.

Financed and leased assets

Dan Gordon, CPA

The obvious advantage to leasing or financing equipment and taking the Section 179 deduction is that you can deduct the full amount of the equipment, without paying the full amount this year. The amount you save in taxes can exceed the payments made this year, making this a very bottom-line friendly deduction.

There is a caveat, of course: When financing or leasing, the full cost of the asset is deducted the year it is acquired — but the payments under the lease or financing agreement may span three or four years. Those payments are only deductible to the extent that there is an interest component in the payments. Therefore, when financing or leasing an asset and taking a Section 179 deduction in year one, subsequent years will require a payment that is, for the most part, nondeductible with no depreciation deduction to offset it.

Limitations to consider

Because Section 179 is intended to help smaller businesses, the deduction comes with limits. There are caps to the total amount that can be written off, which for 2024 is $1.22 million. The deduction begins to phase out dollar-for-dollar after $3.05 million is spent by a given business.

In addition, Section 179 only can be used to reduce profit. It cannot be used to create a loss the way ordinary depreciation can. On the other hand, it’s not an “all-or-nothing” deduction. You can take a Section 179 deduction for part of the cost of an asset and depreciate the rest. This can be done to reduce profit to zero and not fall below without losing the excess basis in an asset to deduct in future years.

As with any legal or accounting strategy, it’s always wise to check with a competent certified public accountant (CPA) or tax attorney to make sure the strategy is appropriate for your situation.

Leave A Comment