Employment issues, tax codes, new regulations, equipment investments — what’s not to love about running a professional pest management firm?

Employment issues, tax codes, new regulations, equipment investments — what’s not to love about running a professional pest management firm?

With the exceptions of the mafia and the county morgue, the inevitabilities of death and taxes weigh heaviest on pest management professionals (PMPs). Come to think of it, tax worries probably don’t ping too high for a Mafioso — at least, not like it does for a PMP.

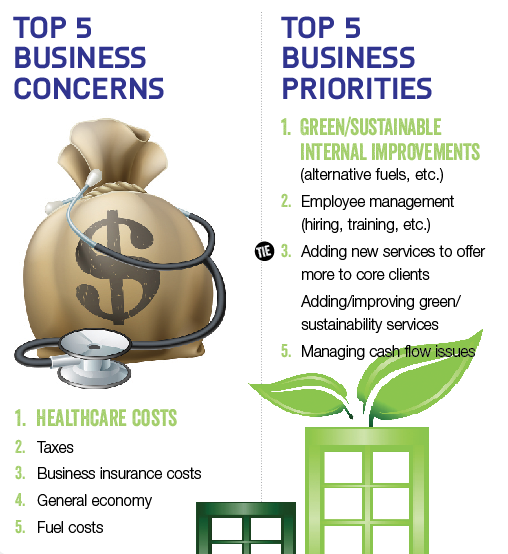

In actuality, in the 2016 Pest Management Professional (PMP) State of the Industry report, respondents named taxes as only their No. 2 business concern. They cited healthcare costs as No. 1, but only by 0.03 of a percentage point in their respected weighted averages (3.66 vs. 3.63). Business insurance costs were third (3.56), followed by the economy (3.43) and then fuel (3.36) and labor (3.31) costs. By comparison, issues like customer cancellations and delinquent payments (tied at 2.58), real estate costs (2.47) and do-it-yourself (DIY) competition (2.43) seemed to be minor nuisances to our readers.

Respondents also looked to ranking their business priorities, and all nine possibilities seem to weigh equally heavily on them — there is only 0.24 of a percentage point between the “top” priority — green/sustainable internal improvements, such as alternative fuels (2.84) — and the “bottom” one of growing the business (2.60). In between are the tasks of employee management, adding on new services, adding or improving green/sustainable services, managing cash flow, maintaining current business, finding new ways to do business, and cutting expenses. It’s hard to pick just one brand of fun, isn’t it?

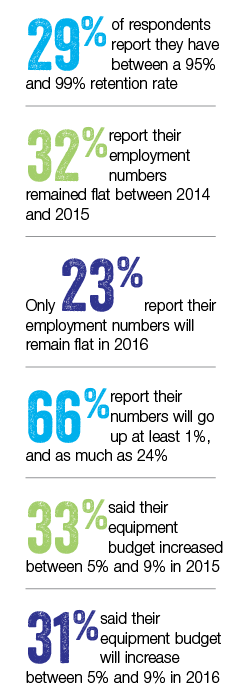

Yet it seems respondents have little need for worrying about maintaining current business. Sure, it isn’t easy, but they seem to be up to the challenge. Five percent boast a 100 percent retention rate in 2015 of their 2014 customers, while another 29 percent cop to a 95 percent to 99 percent rate. All told, 89 percent have at least a 75 percent retention rate — and less than 3 percent admitted to a rate of 49 percent or less.

Yet it seems respondents have little need for worrying about maintaining current business. Sure, it isn’t easy, but they seem to be up to the challenge. Five percent boast a 100 percent retention rate in 2015 of their 2014 customers, while another 29 percent cop to a 95 percent to 99 percent rate. All told, 89 percent have at least a 75 percent retention rate — and less than 3 percent admitted to a rate of 49 percent or less.

Material matters

How did your materials and equipment budget change from 2014 to 2015, and again from 2015 to 2016? We posited this question on the survey, and respondents answered in a manner we pretty much expected: Approximately one-third of them had increased expenses 5 percent to 9 percent in 2015, and plan to do the same next year. Approximately 19 percent report no change from 2014 to 2016, and less than 8 percent expect a decrease in 2015.

How did your materials and equipment budget change from 2014 to 2015, and again from 2015 to 2016? We posited this question on the survey, and respondents answered in a manner we pretty much expected: Approximately one-third of them had increased expenses 5 percent to 9 percent in 2015, and plan to do the same next year. Approximately 19 percent report no change from 2014 to 2016, and less than 8 percent expect a decrease in 2015.

For the year ahead, even fewer expect a break: One respondent expected it to go down 1 percent to 4 percent, and another lone wolf predicts a decrease of 25 percent or more.

What did PMPs buy this year? At least 75 percent of you purchased bait stations, insecticides and uniforms, followed by traps and safety equipment. About 71 percent bought trucks, while 68 percent purchased computers, dusters and monitors (not the same 68 percent, of course). Spray nozzles and backpack sprayers came next, at 65 percent and 64 percent, respectively. Sixty-four percent also purchased vehicle accessories, while 63 percent bought spray guns. Granule spreaders were purchased by 59 percent of respondents, while 57 percent added bait guns and applicators to their inventory. Spray pumps (56 percent) and spray hoses (51 percent) were popular choices as well.

Less than half of you purchased the following in 2015, according to the survey:

⦁ Compressed air sprayers

⦁ Business software

⦁ GPS systems/software

⦁ Aerosol applicators

⦁ Green products

⦁ Handheld devices (personal digital assistants, etc.)

⦁ Hose reels

⦁ Foggers

⦁ Spray rigs

⦁ Subcontracted services

⦁ Foam machines

⦁ Consultants

⦁ Bird/Animal repellers

⦁ Trailers

⦁ Termite bait installation tools

⦁ Soil and tree injectors

⦁ Alternative fuel vehicles

For 2016’s planned purchases, there were few changes from the current year’s invoices. Uniforms jumped from No. 3 to No. 1, and vehicle accessories became a little more popular (No. 7, up from No. 12). Slightly more PMPs plan to purchase alternative fuel vehicles in 2016 (7 percent) than those who actually have done so in 2015 (4 percent).

For 2016’s planned purchases, there were few changes from the current year’s invoices. Uniforms jumped from No. 3 to No. 1, and vehicle accessories became a little more popular (No. 7, up from No. 12). Slightly more PMPs plan to purchase alternative fuel vehicles in 2016 (7 percent) than those who actually have done so in 2015 (4 percent).

Opportunity Knocks

When we asked 2016 PMP State of the Industry respondents what they saw as their company’s top opportunity in the year ahead, there was one with which we simply can’t argue: “Our business is run by the weather. You tell me what kind of weather we’ll have in 2016, and I’ll tell you what our top opportunities will be.”

Beyond the mainstays of bed bugs and termites, here’s a sampling of what some of the other respondents had to say:

⦁  New construction in our market

New construction in our market

⦁ Commercial business

⦁ Starting mosquito control

⦁ Finding innovative ways to attract and maintain a strong crew

⦁ Customer growth through new extended services

⦁ More customers who are not satisfied with their present pest control provider

⦁ Growth into new markets

⦁ Growth in commercial business contracts

⦁ Referrals from satisfied customers

⦁ Becoming better at following our protocols

⦁ Managing overhead

⦁ Doing more commercial and government accounts

⦁ Increasing new-customer base as a result of sales team

Leave A Comment